Facts About Pkf Advisory Services Revealed

Facts About Pkf Advisory Services Revealed

Blog Article

The 10-Second Trick For Pkf Advisory Services

Table of ContentsThe Main Principles Of Pkf Advisory Services Pkf Advisory Services Things To Know Before You BuyGet This Report about Pkf Advisory ServicesNot known Details About Pkf Advisory Services The 10-Minute Rule for Pkf Advisory Services

If you're looking for additional information beyond what you can discover on-line, it's very easy to get started with a comprehensive, tailored financial strategy that you can examine without expense or dedication. Appreciate the ongoing support of a devoted consultant in your edge.The complete price you are anticipated to pay, consisting of the internet advisory cost and the underlying fund costs and expenditures, is about 1.00% of assets under management. For additional details on costs and expenses of the solution, please review the Costs and Settlement area of the. The T. Rowe Rate Retired Life Advisory Solution is a nondiscretionary economic planning and retired life earnings preparation service and an optional took care of account program provided by T.

Brokerage firm makes up the Retirement Advisory Service are provided by T. Rowe Cost Investment Solutions, Inc., member FINRA/SIPC, and are carried by Pershing LLC, a BNY Mellon business, participant NYSE/FINRA/SIPC, which acts as a clearing broker for T. Rowe Cost Financial Investment Providers, Inc. T. Rowe Cost Advisory Solutions, Inc. and T.

Pkf Advisory Services - Questions

Giving advice is a crucial part of IFC's approach to create markets and mobilize personal investment. With this job, we help develop the needed problems that will bring in one of the most private funding, making it possible for the economic sector to grow. IFC is shifting to a much more strategic approach, methodically linking our advising programs to the biggest demands identified in Globe Bank Group country and industry strategies.

Financial suggestions can be useful at transforming points in your life. Like when you're beginning a household, being retrenched, preparing for retirement or taking care of an inheritance. When you fulfill with an adviser for the very first time, work out what you desire to obtain from the advice. Before they make any referrals, an advisor ought to put in the time to review what is necessary to you.

The smart Trick of Pkf Advisory Services That Nobody is Talking About

As soon as you've accepted proceed, your monetary advisor will prepare an economic strategy for you. This is provided to you at one more meeting in a record called a Statement of Suggestions (SOA). Ask the advisor to discuss anything you don't understand. You must always really feel comfortable with your adviser and their suggestions.

Before you purchase an MDA, compare the benefits to the expenses and threats. To safeguard your money: Don't provide your consultant power of attorney. Never ever sign a blank document. Put a time limit on any type of authority you offer to purchase and sell investments in your place. Urge all communication about your financial investments are sent to you, not just your adviser.

If you're relocating to a brand-new consultant, you'll require to arrange to transfer your monetary documents to them. If you require assistance, ask your consultant to explain the process.

Excitement About Pkf Advisory Services

However numerous possessions come with responsibilities affixed. So, it comes to be essential to figure out the real value of a property. The knowledge of straight from the source clearing up or canceling the responsibilities comes with the understanding of your funds. The general process aids construct assets that don't come to be a worry in the future. It used to be called conserving for a rainy day.

Why? Like your best vehicle man, financial consultants have years of training and experience behind them. They have a deep understanding of read financial items, market activity, and run the risk of monitoring so you can trust that the choices that make up your monetary plan are made with self-confidence. Just how will you know these decisions are made with your best passion in mind? If your economic advisor is a fiduciary, after that they are legitimately bound to act in your benefit not their own.

The Of Pkf Advisory Services

This is what you can utilize to attempt the sushi put the street or see your favored band at Red Rocks. PKF Advisory Services. When it pertains to taxes, a great economic advisor will certainly make certain that you're only paying the minimum quantity you're needed to pay, helping you put a few of your hard-earned refund in your pocket

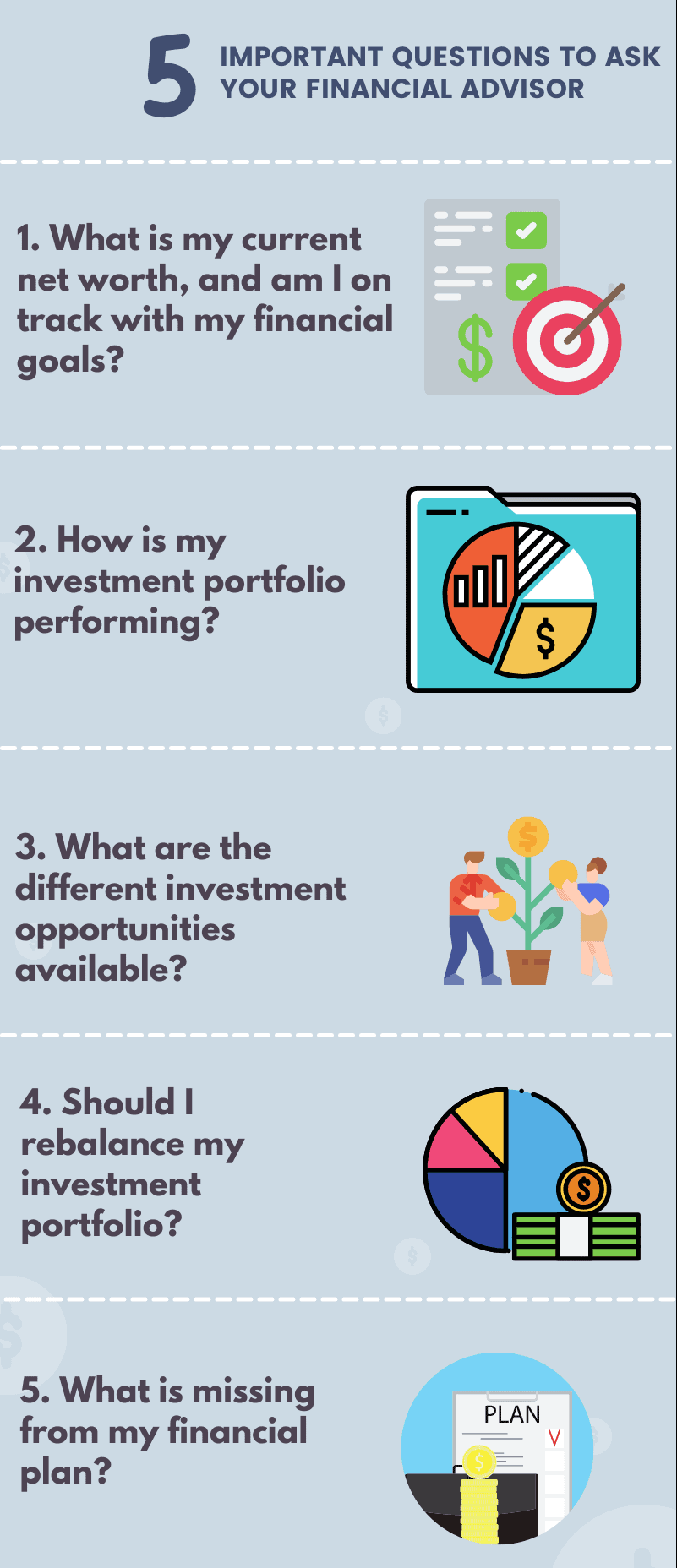

The possible value of economic guidance depends on your financial scenario. You need assistance setting financial objectives for your future You're not certain how to spend your money You're in the center of (or preparing for) a major More Info life occasion You need liability or an objective second viewpoint You simply do not like dealing with money To determine if functioning with a financial consultant is right for you and make certain a successful partnership, the best point to do is ask good inquiries up front.

Below are a few examples of concerns you can ask an economic advisor in the very first conference. An economic advisor who is a fiduciary is called for by legislation to act in your ideal interest.

Report this page